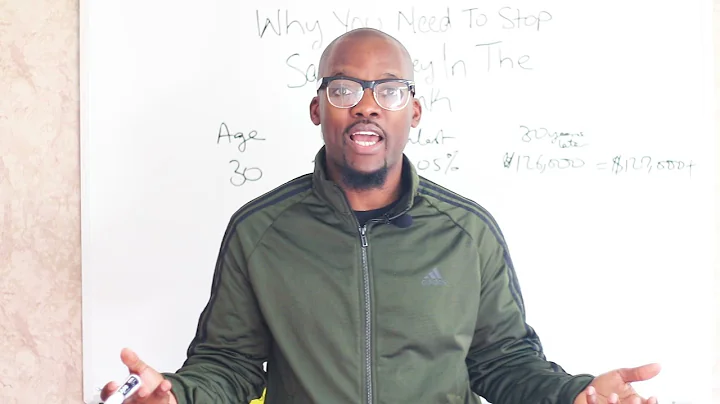

Which one is not a benefit of saving money at the bank?

Answer and Explanation:

A savings account does not offer the benefit of regular and unlimited withdrawals to the account holder like a current account. There are federal restrictions that limit the number of times an individual or a company can withdraw money.

- Your money is safe. ...

- Your money is protected against error and fraud. ...

- You get your money faster with no check-cashing.

- You can make online purchases with ease and peace.

- You have access to other products from the bank. ...

- You can transfer money to family and friends with.

- You have proof of payment.

- You're limited to what you can afford: your savings may only get you so far.

- It's risky to spend all your savings: you might need your savings for a personal emergency.

- Your responsibility for success: having more people behind your business could lead to more success.

Savings bond, Certificate of deposit(CD) and basic savings are all types of savings. These will earn interests over the initial amount in certain period of time. But stock market is not a type of savings, rather its a platform where one buys and sells stocks.

Disadvantages of Savings Accounts

Interest rates are variable, not fixed. Inflation might erode the value of your savings. Some financial institutions require a minimum balance to earn the highest interest rate. Some accounts might charge fees.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

- Lower savings rates. Banks generally are less competitive than credit unions in terms of interest rates for savings accounts. ...

- Higher loan rates. Interest rates for loans from banks tend to be higher than interest rates charged by credit unions. ...

- Customer satisfaction.

| Pros | Cons |

|---|---|

| High interest earnings will grow your money exponentially over time. | Limited to certain types and amounts of withdrawals and transfers. |

| You can withdraw at any time during your bank's business hours. | May require a minimum balance to avoid paying fees. |

- The money can be lost or stolen. Hiding cash under the mattress, behind a picture frame or anywhere in your house always carries the risk of being misplaced, damaged or stolen. ...

- The money isn't growing. When cash doesn't grow, it loses some of its value.

What is the disadvantage of not saving money?

Emergency Situations: Without savings, you'll be more vulnerable to unexpected expenses like medical bills, car repairs, or sudden job loss. This can lead to debt or financial stress. Debt Accumulation: When unexpected expenses arise, you might resort to using credit cards or taking out loans to cover them.

- The Disadvantages of Saving Money. Debt is Expensive. Fear of Missing Out (FOMO) Your Money is Losing its Value. You're Missing Opportunities to Increase Your Wealth.

- Am I really at a disadvantage if I save?

Instability -

A great disadvantage of money is that its value does not remain constant which creates instability in the economy.

The interest rate on savings generally is lower compared with investments. While safe, savings are not risk-free: the risk is that the low interest rate you receive will not keep pace with inflation.

Expert-Verified Answer. All of the following are benefits of checking accounts, except You will never pay any account fees or ATM fees. Thus, option (d) is correct.

High-Yield Savings Account

This is one of the best types of savings accounts to maximize your money's growth. Online banks often offer different types of high yield savings accounts to attract savers who want to earn a better interest rate than what is found at brick-and-mortar banks and credit unions.

Without savings, you are ill-equipped to handle unexpected expenses, including medical bills, car repairs, or unemployment. This unpreparedness can result in financial stress, potentially forcing you to rely on high-interest loans or credit cards.

So if you keep your retirement nest egg in a savings account, you might lose out on the higher returns you need to outpace inflation over time. Also, a savings account won't give you any sort of tax break on your money.

Keeping too much of your money in savings could mean missing out on the chance to earn higher returns elsewhere. It's also important to keep FDIC limits in mind.

Banks can fail for a variety of reasons including undercapitalization, liquidity, safety and soundness, and fraud. The chartering agency has the authority to terminate the bank's charter and appoint the FDIC to resolve the failure.

What is the main disadvantage of a big bank?

Some Cons of Big Banks

In some cases, larger financial institutions may offer less competitive rates on loans and charge larger fees than community banks or small credit unions. If you take out a loan with a big bank, it might take longer to process, too.

Public sector banks are safe. Though it is not a stated guarantee, it is an implied responsibility of the Government. In case something goes wrong, the Government steps in and finds a solution.

- Advantages.

- Earn Interest. A savings account helps you earn interest on the deposited amount. ...

- Safest Investment Option. ...

- Minimum Investment Amount. ...

- Disadvantages.

- Interest Rates Can Change. ...

- Easy Access. ...

- Minimum Balance Requirement.

Bank accounts are cheaper

You can deposit and cash your checks at the institution where you have a bank account for free. Paying bills: Without a bank account, you probably rely on check cashing outlets, telephone bill pay or money orders—all of which have attached fees—to pay your bills.

No interest or low interest: Traditionally, current accounts do not offer interest, and even if they do, the interest rates might not be as attractive as savings accounts. Minimum balance requirements: Some types of current accounts do have minimum balance requirements, failing which there could be penalties.

References

- https://www.fdic.gov/getbanked/pdf/top-reasons-to-open-a-bank-account.pdf

- https://www.bankrate.com/banking/savings/how-to-save-money-fast/

- https://www.bankrate.com/banking/savings/how-much-money-should-i-save-each-month/

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/money-market-vs-cd-vs-savings

- https://www.cnbc.com/select/pros-and-cons-high-yield-savings-accounts/

- https://lookingafteryourpennies.com/disadvantages-of-saving-money/

- https://www.finder.com/savings-accounts/12-interest-savings-account

- https://www.axisbank.com/progress-with-us-articles/advantages-and-disadvantages-of-savings-account

- https://www.experian.com/blogs/ask-experian/pros-cons-of-buying-stocks/

- https://lottie.org/fees-funding/best-savings-accounts-for-over-60s/

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://fdlcu.com/should-you-keep-cash-at-home.html

- https://www.halifax.co.uk/savings/help-guidance/saving-explained/what-is-a-lump-sum.html

- https://heartlandcu.org/2018/10/23/the-behavior-gap-simple-ways-to-stop-doing-dumb-things-with-money/

- https://www.forbes.com/advisor/banking/how-much-cash-should-you-keep-in-the-bank/

- https://www.investopedia.com/financial-edge/1211/why-you-should-stick-with-the-big-banks.aspx

- https://finance.yahoo.com/news/american-couples-count-needing-least-130036437.html

- https://finance.yahoo.com/news/average-american-inheritance-wealth-level-130120356.html

- https://www.ramseysolutions.com/retirement/can-you-retire-on-1-million

- https://finance.yahoo.com/news/10-genius-things-dave-ramsey-120115148.html

- https://www.chegg.com/homework-help/questions-and-answers/following-benefit-savings-account-group-answer-choices-way-save-child-s-education-protecti-q136432376

- https://typeset.io/questions/what-are-the-disadvantage-of-saving-money-on-students-3xbhxd6skt

- https://nomoredebts.org/blog/manage-money-better/the-7-smartest-things-you-can-do-for-your-finances

- https://brainly.com/question/29214667

- https://www.tiaa.org/public/learn/personal-finance-101/how-much-of-my-income-should-i-save-every-month

- https://homework.study.com/explanation/which-of-the-following-is-not-a-benefit-of-putting-money-in-a-savings-account-a-you-can-make-frequent-withdrawals-b-you-can-earn-interest-c-it-is-harder-to-spend-the-money-d-the-money-is-safe-and-secure.html

- https://quizlet.com/658057817/financial-planning-unit-2-flash-cards/

- https://www.approachfp.com/retire-on-500k/

- https://www.moneysavingexpert.com/savings/best-regular-savings-accounts/

- https://www.fool.com/the-ascent/banks/articles/3-good-reasons-not-to-keep-money-in-a-savings-account/

- https://www.comparethemarket.com/current-accounts/basic-bank-account/

- https://thebudgetnista.com/what-is-the-golden-rule-of-saving-money/

- https://www.businessinsider.com/personal-finance/can-you-take-money-out-of-a-savings-account

- https://www.moneyfit.org/is-money-the-root-of-all-evil/

- https://www.forbes.com/advisor/banking/places-to-save-money/

- https://www.forbes.com/sites/qai/2023/02/02/the-pros-and-cons-of-high-yield-savings-accounts-and-how-they-compare-to-investing/

- https://www.quora.com/Does-having-more-money-mean-a-higher-IQ

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://time.com/personal-finance/article/best-way-to-invest-100k/

- https://consumer.westchestergov.com/money-management/benefits-of-a-bank-account

- https://www.progressive.com/lifelanes/turning-points/handle-financial-windfall/

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://www.penfed.org/learn/is-money-safer-in-checking-or-savings

- https://www.usatoday.com/money/blueprint/banking/50-30-20-budget-rule/

- https://quizlet.com/646059640/college-personal-finance-ch4-flash-cards/

- https://www.bankrate.com/banking/checking-vs-savings-accounts/

- https://www.nerdwallet.com/article/banking/data-2023-savings-report

- https://www.investopedia.com/articles/personal-finance/101315/7-smart-ways-raise-cash-fast.asp

- https://www.forbes.com/advisor/banking/money-market-account/money-market-account-vs-savings-account/

- https://www.indusind.com/iblogs/categories/msme/pros-and-cons-of-online-current-accounts/

- https://www.biltmoreloanandjewelry.com/blog/why-saving-matters-a-look-at-the-ten-consequences/

- https://brainly.com/question/30486570

- https://www.moneyhelper.org.uk/en/savings/types-of-savings/regular-savings-accounts

- https://www.brewin.co.uk/insights/where-save-and-invest-lump-sum-money

- https://segurosypensionesparatodos.fundacionmapfre.org/en/investment/investment-products/investment-funds/

- https://www.chase.com/personal/banking/education/basics/checking-vs-savings-account

- https://www.forbes.com/advisor/in/banking/types-of-savings-accounts/

- https://www.comerica.com/insights/personal-finance/advantages-of-a-savings-account-security-access-and-more.html

- https://finance.yahoo.com/news/20-000-good-amount-savings-160036732.html

- https://www.investopedia.com/what-can-i-earn-with-10k-in-a-cd-8400034

- https://finance.yahoo.com/news/much-savings-70-140006145.html

- https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire

- https://www.huntington.com/learn/saving/differences-between-checking-and-savings

- https://www.icicibank.com/blogs/saving-account/advantages-disadvantages-savings-account

- https://www.bbh.com/us/en/insights/private-banking-insights/four-ways-to-maximize-your-first-financial-windfall.html

- https://www.fdic.gov/analysis/cfr/2014/wp2014/2014-04.pdf

- https://www.takechargeamerica.org/the-many-downsides-of-being-unbanked/

- https://www.moneycontrol.com/news/business/personal-finance/how-safe-is-your-bank-remember-mental-peace-is-important-9807581.html

- https://www.nerdwallet.com/article/banking/savings-accounts-basics

- https://moneyweek.com/personal-finance/savings/nsandi-versus-savings

- https://brainly.com/question/41517675

- https://www.livemint.com/industry/banking/what-is-basic-a-savings-bank-account-how-it-is-different-from-a-regular-savings-account-11703702968487.html

- https://study.com/academy/lesson/what-is-a-checking-account-definition-types-advantages.html

- https://www.sofi.com/learn/content/how-much-of-your-paycheck-should-you-save/

- https://lyonswealth.com/blog-details/how-to-invest-500k

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.usnews.com/banking/articles/credit-union-vs-a-bank

- https://www.sofi.com/learn/content/can-the-government-take-money-out-of-your-account/

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.cnbc.com/select/saving-vs-investing/

- https://dspmuranchi.ac.in/pdf/Blog/8)%20DEMERITS%20OF%20MONEY.pdf

- https://www.moneysupermarket.com/savings/saving-lump-sum/

- https://www.investor.gov/additional-resources/information/youth/teachers-classroom-resources/risk-and-return

- https://time.com/personal-finance/article/what-is-a-savings-account/

- https://www.nerdwallet.com/article/banking/saving-vs-investing-when-to-choose-how-to-do-it

- https://www.nerdwallet.com/article/banking/how-much-money-in-checking-and-savings

- https://www.experian.com/blogs/ask-experian/are-high-yield-savings-accounts-safe/

- https://www.bankrate.com/retirement/average-monthly-social-security-check/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.bankrate.com/banking/savings/savings-account-average-balance/

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://quizlet.com/80817357/personal-finance-unit-4-flash-cards/

- https://countingup.com/resources/advantages-and-disadvantages-of-personal-savings-in-business/

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.businessinsider.com/personal-finance/types-of-savings-accounts

- https://quizlet.com/247370958/savings-account-flash-cards/

- https://brainly.com/question/9317176

- https://www.axisbank.com/progress-with-us-articles/how-much-money-should-i-keep-in-my-savings-account

- https://moneywise.com/investing/how-to-invest-500000

- https://www.fool.com/the-ascent/banks/articles/is-10000-too-much-to-keep-in-a-savings-account/

- https://www.bankrate.com/banking/how-much-cash-should-you-keep-at-home/

- https://www.cnbc.com/2024/04/09/most-of-americans-are-living-paycheck-to-paycheck-heres-why.html

- https://www.sippadvice.co.uk/guides/can-i-retire-at-60-with-300k/

- https://www.annuity.org/retirement/estate-planning/average-inheritance/

- https://www.usbank.com/wealth-management/financial-perspectives/financial-planning/extra-cash.html

- https://fortune.com/recommends/banking/saving-vs-investing/

- https://www.bankrate.com/banking/savings/what-is-a-savings-account/

- https://www.fool.com/the-ascent/research/average-savings-account-balance/

- https://www.coursesidekick.com/economics/386990

- https://www.banks.com/articles/banking/savings-accounts/savings-accounts-advantages-disadvantages/

- https://www.fool.com/the-ascent/banks/articles/can-a-bank-take-money-from-your-account-without-your-permission/

- https://medium.com/@umarbuneri/why-humans-are-so-much-attracted-to-money-why-we-want-what-we-want-the-role-of-money-in-human-e48c352a68d

- https://www.experian.com/blogs/ask-experian/is-5000-emergency-fund-enough/

- https://time.com/personal-finance/article/how-to-invest-20k/

- https://www.nerdwallet.com/article/banking/types-of-savings-accounts

- https://www.cnbc.com/select/savings-by-age/

- https://www.quora.com/What-are-the-consequences-of-not-saving-money-when-our-income-is-low-How-long-would-it-take-to-become-financially-stable-if-we-didnt-save-any-money

- https://www.hdfcbank.com/personal/resources/learning-centre/save/what-are-the-types-of-savings-accounts