What is a savings account in simple terms?

A savings account is a type of bank account designed for saving money that you don't plan to spend right away. Like a checking account, you can make withdrawals and access the money as needed. But with savings accounts, the bank pays you compounding interest just for keeping funds in your account.

This is the most basic type of account you can open at any bank. A Savings Account, by definition, allows you to deposit your money, safe with the bank, so you don't have to carry it around with you or hide it in that rusted old steel safe at home. Don't worry, you can withdraw these funds when you need them.

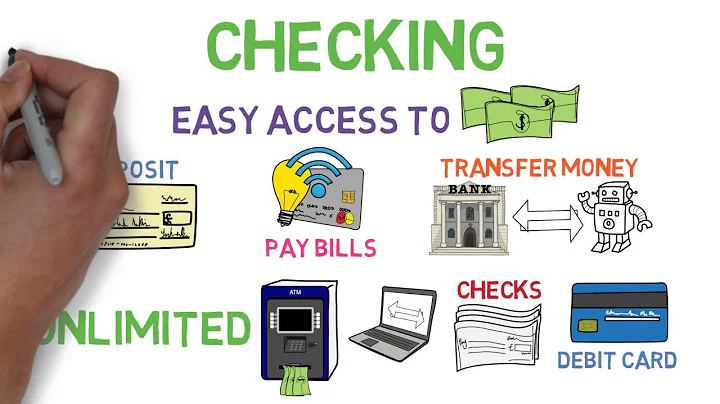

A savings account is a deposit account designed to hold money you don't plan to spend immediately. This is different from a checking account, a transactional account meant for everyday spending, allowing you to write checks or make purchases and ATM withdrawals using a debit card.

Savings comprise the amount of money left over after spending. People may save for various life goals or aspirations such as retirement, a child's college education, the down payment for a home or car, a vacation, or several other examples. Savings may commonly be earmarked for emergencies.

A savings account is an interest-bearing deposit account held at a bank or other financial institution. Though these accounts typically pay only a modest interest rate, their safety and reliability make them a good option for parking cash that you want available for short-term needs.

Saving means self-reliance.

If you save your money, you don't have to rely on your parents or anyone else to handle your purchase. This fact doesn't mean their opinion no longer matters. It simply means you can take some financial weight off their shoulders and carry it yourself, earning some independence.

Saving means you can take calculated risks. Part of the importance of saving money is to build cash reserves so you can take calculated risks with less worry. If you don't have any savings, it may be harder to pursue certain passions. Take starting a business, for example.

Compound interest refers to the interest earned on both the initial deposit in a savings account and the interest that accrues. For example, if your initial deposit was $500, the compound interest would be calculated based on that amount plus the amount of accumulated interest. Most savings accounts compound interest.

Because it usually provides interest, allows for easy withdrawals, and is insured, a savings account is most useful for money that you would need in the near future.

Methods of saving include putting money in, for example, a deposit account, a pension account, an investment fund, or kept as cash. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher.

Are savings accounts worth it?

A savings account is a safe place to put your money when you can't afford to lose any or think you'll need it in an emergency. It's also a good place to put some of your investments as a hedge against losses – you can't lose everything if some of your money is in an ordinary savings account, after all.

You deposit money into your savings account. The account provider earns interest on this money. In return, the bank pays you some of the interest on the funds in your account each year. The amount of interest you earn depends on the type of savings account you have.

How does a savings account work? A savings account is an account where you can easily deposit money and earn interest, helping you save towards a money goal. You earn interest on your balance, helping you grow your savings.

They're not only a safe place to keep money and earn a little interest, but they're also a proven way to help teach your child about money management and saving toward financial goals.

- Interest rates are variable, not fixed.

- Inflation might erode the value of your savings.

- Some financial institutions require a minimum balance to earn the highest interest rate.

- Some accounts might charge fees.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

- MAKE A BUDGET. The first step for anybody seriously interested in how to save money is to make a budget. ...

- AUTOMATE YOUR TO-DO LIST. ...

- TAKE A BREATHER.

One important disadvantage of a savings bank account is that the interest rates offered by the bank are variable. This means that the bank has the right to make changes to the interest rate.

A money market account (MMA) is a savings account that typically pays higher interest rates than regular savings accounts. MMAs usually offer tiered rates, meaning you can earn an even higher rate on large balances or on part of your balance over a certain level.

As of April 2024, no banks are offering 7% interest rates on savings accounts. Two credit unions have high-interest checking accounts: Landmark Credit Union Premium Checking with 7.50% APY and OnPath Credit Union High Yield Checking with 7.00% APY.

What are the pros and cons of savings?

Pros and Cons of Saving

Saving has many benefits such as providing a financial safety net for unexpected events, liquidity for purchases and other short-term goals, and being safe from loss. However, there are also some drawbacks to consider, such as missing out on potential higher returns from riskier investments.

For savings, aim to keep three to six months' worth of expenses in a high-yield savings account, but note that any amount can be beneficial in a financial emergency. For checking, an ideal amount is generally one to two months' worth of living expenses plus a 30% buffer.

With this rule, you aim to: Use 50 percent of your income on essential expenses (housing, food, utility bills, etc.) Apply 30 percent or less of your income on "wants." Put 20 percent of your income away in a savings account.

Once you've made a deposit, the money in your savings account will begin to earn interest. The amount earned depends on a few factors, including your savings account interest rate, APY, the amount of money you deposit and how long you keep money in your account.

| Account type | APY | Minimum opening deposit |

|---|---|---|

| Newtek Bank | 5.25% | $0 |

| Quontic Bank | 4.50% | $100 |

| Ally Bank | 4.25% | $0 |

| Cloudbank 24/7 | 5.26% | $1 |

References

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://finance.yahoo.com/news/live-1-000-per-month-200011859.html

- https://www.nab.com.au/personal/life-moments/manage-money/money-basics/what-is-savings-account

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://en.wikipedia.org/wiki/Minimum_daily_balance

- https://www.bankrate.com/banking/savings/types-of-savings-accounts/

- https://diversifiedllc.com/article/what-are-the-pros-and-cons-of-traditional-banking/

- https://www.investopedia.com/how-many-savings-accounts-should-i-have-7775519

- https://www.co-operativebank.co.uk/tools-and-guides/savings/how-to-pay-money-into-a-savings-account/

- https://www.huntington.com/learn/checking-basics/online-banking-vs-traditional-banking

- https://www.raisin.co.uk/savings-accounts/locked-savings-accounts

- https://www.equifax.com/personal/education/life-stages/articles/-/learn/how-much-should-i-have-saved-by-middle-age/

- https://playmoneysmart.fdic.gov/tools/4

- https://www.nerdwallet.com/uk/savings/regular-savings-account/

- https://www.fool.com/the-ascent/personal-finance/articles/should-you-empty-your-savings-accounts-to-become-debt-free/

- https://www.creditkarma.com/ck-money/checking

- https://en.wikipedia.org/wiki/Saving

- https://www.forbes.com/advisor/banking/how-much-cash-should-you-keep-in-the-bank/

- https://www.bankrate.com/banking/savings/should-your-child-have-a-savings-account/

- https://www.thebalancemoney.com/typical-minimum-balance-for-traditional-savings-accounts-5204547

- https://www.bankrate.com/banking/savings/what-is-a-savings-account/

- https://www.forbes.com/advisor/banking/bank-account-minimum-deposit-minimum-balance-requirements/

- https://www.forbes.com/advisor/in/banking/types-of-savings-accounts/

- https://www.hdfcbank.com/personal/resources/learning-centre/save/what-is-a-savings-account

- https://www.gripinvest.in/blog/earn-50K-per-month

- https://quizlet.com/646059640/college-personal-finance-ch4-flash-cards/

- https://www.alliantcreditunion.org/help/how-is-a-savings-account-most-useful

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.cnet.com/personal-finance/banking/advice/yes-you-can-spend-from-your-savings-account-but-should-you/

- https://www.forbes.com/advisor/banking/online-banks-vs-traditional-banks/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://brainly.com/question/29214667

- https://www.suntecgroup.com/articles/how-minimum-balance-requirements-can-benefit-banks-and-customers/

- https://time.com/personal-finance/article/how-much-cash-to-keep-in-checking-account/

- https://www.takingcharge.csh.umn.edu/can-money-buy-happiness

- https://www.quora.com/How-much-cash-can-be-deposited-into-a-savings-bank-account-per-year-without-being-taxed-by-the-Internal-Revenue-Service-IRS

- https://www.unionbankofindia.co.in/english/ultimate-guide-to-savings-accounts.aspx

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/money-market-vs-cd-vs-savings

- https://www.icicibank.com/blogs/saving-account/advantages-disadvantages-savings-account

- https://www.nerdwallet.com/article/banking/how-much-should-i-have-in-savings

- https://www.bankrate.com/banking/savings/average-savings-interest-rates/

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://www.meettally.com/blog/traditional-savings-account

- https://www.investopedia.com/terms/s/savings.asp

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.investopedia.com/how-much-cash-can-you-deposit-at-a-bank-8553483

- https://www.bankrate.com/banking/checking-vs-savings-accounts/

- https://www.marketwatch.com/guides/banking/chase-review/

- https://www.oneazcu.com/about/financial-resources/saving-budgeting/which-savings-account-will-earn-you-the-most-money/

- https://www.coursesidekick.com/economics/386990

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://bankaroo.com/money-basics-for-kids-the-reasons-why-you-should-save/

- https://www.dbs.com/digibank/in/articles/save/how-to-calculate-monthly-average-balance

- https://www.latimes.com/compare-deals/banking/savings/7-percent-interest-savings-accounts

- https://www.rocketmoney.com/learn/personal-finance/living-paycheck-to-paycheck

- https://www.fool.com/the-ascent/banks/articles/heres-what-happens-when-you-leave-a-lot-of-money-in-your-savings-account/

- https://time.com/personal-finance/article/what-is-a-savings-account/

- https://www.forbes.com/advisor/banking/savings/what-is-a-savings-account/

- https://www.forbes.com/advisor/banking/cds/7-percent-cd-rate/

- https://www.pnc.com/insights/personal-finance/save/how-much-should-i-have-in-savings.html

- https://www.linkedin.com/pulse/3-primary-types-bookkeeping-anthony-thompson-dmnpc

- https://www.cnbc.com/select/how-much-money-should-you-keep-in-bank-accounts/

- https://www.synchronybank.com/blog/what-is-a-savings-account/

- https://www.cnn.com/cnn-underscored/money/can-you-add-money-to-a-cd

- https://homework.study.com/explanation/what-is-the-major-disadvantage-of-having-a-regular-savings-account-a-not-having-enough-growth-potential-b-having-a-minimum-amount-of-money-deposited-to-keep-it-open-c-having-an-expiration-date-d-not-being-able-to-access-money-for-a-specified-amount-o.html

- https://www.nasdaq.com/articles/5-key-signs-youre-keeping-too-much-money-in-your-savings-account

- https://www.businessinsider.com/personal-finance/5-percent-interest-savings-accounts

- https://www.moderntreasury.com/learn/what-is-an-fbo-account

- https://www.usnews.com/banking/articles/benefits-of-having-a-savings-account

- https://www.forbes.com/advisor/banking/checking/types-of-checking-accounts/

- https://www.sofi.com/learn/content/avoiding-minimum-balance-fee/

- https://finance.yahoo.com/news/retire-2-000-month-frugal-130016009.html

- https://fortune.com/recommends/banking/traditional-savings-account/

- https://www.halifax.co.uk/savings/help-guidance/saving-explained/what-is-a-lump-sum.html

- https://www.quora.com/What-do-you-consider-a-small-amount-of-money

- https://www.banks.com/articles/banking/savings-accounts/savings-accounts-advantages-disadvantages/

- https://www.investopedia.com/terms/m/minimum-balance.asp

- https://www.moneysavingexpert.com/savings/best-regular-savings-accounts/

- https://www.axisbank.com/progress-with-us-articles/advantages-and-disadvantages-of-savings-account

- https://smartasset.com/career/what-should-my-net-worth-be-at-35

- https://www.forbes.com/advisor/banking/checking/average-checking-account-balance/

- https://www.cnbc.com/2017/09/14/how-much-money-the-average-millennial-has-in-savings.html

- https://gocardless.com/guides/posts/what-is-a-passbook-and-how-is-it-used/

- https://finance.yahoo.com/news/20-000-good-amount-savings-160036732.html

- https://renasantnation.com/three-ways-to-save-money

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://www.forbes.com/advisor/banking/savings/how-much-should-i-have-saved-by-30/

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.cbsnews.com/news/how-much-is-too-much-money-for-a-high-yield-savings-account/

- https://homework.study.com/explanation/a-drawback-of-a-regular-savings-account-is-a-a-low-rate-of-return-b-a-minimum-required-deposit-c-not-being-insured-d-a-possible-penalty-for-early-withdrawal-e-all-of-these-are-drawback-of-a-regular-savings-account.html

- https://www.comerica.com/insights/personal-finance/advantages-of-a-savings-account-security-access-and-more.html

- https://www.experian.com/blogs/ask-experian/is-5000-emergency-fund-enough/

- https://www.finder.com/savings-accounts/savings-account-you-cant-withdraw-from

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://www.hdfcbank.com/personal/resources/learning-centre/save/what-are-the-types-of-savings-accounts

- https://www.forbes.com/advisor/banking/savings/types-of-savings-accounts/

- https://finance.yahoo.com/news/much-money-millionaires-put-checking-120013872.html

- https://brainly.com/question/41557870

- https://quizlet.com/370269258/consumers-chapter-3-savings-flash-cards/

- https://www.usnews.com/banking/articles/how-to-calculate-savings-account-interest

- https://www.discover.com/online-banking/banking-topics/3-reasons-to-save-more-money/

- https://www.sofi.com/learn/content/surviving-on-1000-a-month/

- https://www.toppr.com/guides/fundamentals-of-accounting/accounting-process/types-of-accounts/

- https://www.marketwatch.com/picks/5-things-you-should-never-do-with-your-savings-18366c78

- https://www.cnn.com/cnn-underscored/money/average-american-savings

- https://consumer.westchestergov.com/money-management/benefits-of-a-bank-account

- https://www.nerdwallet.com/article/banking/types-of-savings-accounts

- https://www.gobankingrates.com/saving-money/budgeting/how-to-survive-on-500-dollars-a-month/

- https://www.bankrate.com/uk/savings-accounts/choosing-a-savings-account/

- https://www.wellsfargo.com/financial-education/basic-finances/manage-money/cashflow-savings/pay-yourself-first/

- https://fortune.com/recommends/banking/best-savings-accounts/

- https://www.chase.com/personal/banking/education/budgeting-saving/the-best-reasons-to-open-a-savings-account

- https://quizlet.com/442558382/savings-accounts-flash-cards/

- https://www.ally.com/help/bank/savings-money-market/

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www.fool.com/the-ascent/banks/articles/3-ways-you-can-lose-money-in-a-savings-account/

- https://www.moneyhelper.org.uk/en/savings/types-of-savings/regular-savings-accounts

- https://www.nerdwallet.com/article/banking/accounts-at-multiple-banks

- https://www.icicibank.com/blogs/saving-account/what-is-monthly-average-balance

- https://www.cnbc.com/select/can-you-have-too-much-in-savings/

- https://www.forbes.com/advisor/banking/savings/are-high-yield-savings-accounts-worth-it/

- https://www.cnbc.com/select/tips-for-getting-your-first-100k/

- https://www.cnbc.com/select/how-much-money-you-should-save-every-paycheck/