What is a basic savings account called?

Traditional or Regular Savings Account

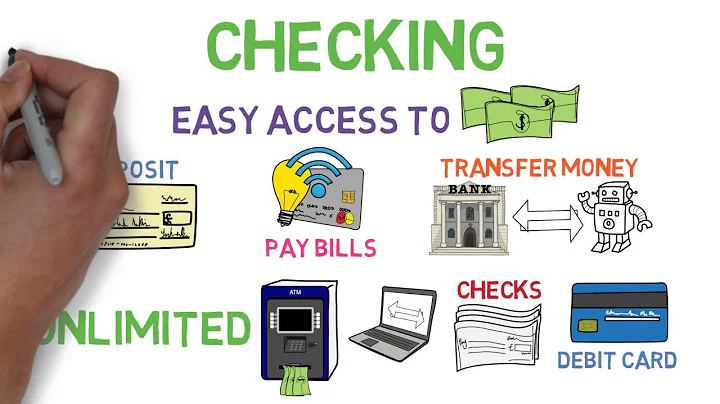

A savings account is a deposit account designed to hold money you don't plan to spend immediately. This is different from a checking account, a transactional account meant for everyday spending, allowing you to write checks or make purchases and ATM withdrawals using a debit card.

- Regular savings account: earns interest and offers quick access to funds.

- Money market account: earns interest and may provide check-writing privileges and ATM access.

- Certificate of deposit, or CD: usually has the highest interest rate among savings accounts, but no access to funds.

A savings account is also known as a demand deposit. Web-only banks offer both online transactions and face-to-face transactions.

The Simple Saver is a savings account powered by Santander International which allows you to save and withdraw flexibly. The account has an underlying interest rate of 4% AER (variable) – this is the rate you will earn after a year, including compounding. The interest rate may change.

Zero Balance or Basic Savings Account

This is similar to the regular Savings Account, but unlike that account, you are not required to maintain any minimum balance for this account. It does, however, come with an ATM/Debit Card for your daily transactions.

What is a basic bank account? A basic bank account is a banking option for those who are facing financial difficulty or have a poor credit history, which means they may not be eligible to open a standard current account.

The most common savings account is a traditional savings account at a bank or credit union.

- Traditional savings accounts. A traditional savings account is essentially a place to hold your money that earns interest. ...

- High-yield savings accounts. ...

- Certificates of deposit. ...

- Money market accounts. ...

- Cash management accounts. ...

- Specialty savings accounts.

We'll discuss seven common savings buckets below: emergency, rainy day, sinking, vacation, splurge, medical, and long-term. While not all of these categories will be applicable to everyone, understanding what's available may help you decide what could work best for your financial situation and goals.

Which saving account is best?

| Sr.No. | Bank Name | Rates of Interest(p.a.) |

|---|---|---|

| 1 | State Bank of India | 2.70% - 3.00% |

| 2 | Union Bank of India | 2.75% - 3.55% |

| 3 | HDFC Bank | 3.00% - 3.50% |

| 4 | ICICI Bank | 3.00% |

A minimum account balance for a traditional savings account is the least amount of money you must keep in your account to avoid fees. Typical minimum account balance requirements for traditional savings accounts range from $300 to $500, although amounts vary and some banks have no minimum requirements.

Key Takeaways. Current account savings accounts (CASA) are a type of non-term deposit account. A CASA pays a lower interest rate than term deposits, such as certificates of deposit, and is thus a cheaper source of income for the financial institution.

One important disadvantage of a savings bank account is that the interest rates offered by the bank are variable. This means that the bank has the right to make changes to the interest rate.

| Bank | Interest Rate of Savings Bank Account |

|---|---|

| Union Bank of India | 2.75% - 3.55% |

| HDFC Bank | 3.00% - 3.50% |

| ICICI Bank | 3.00% |

| Axis Bank | 3.00% - 3.50% |

| Pros | Cons |

|---|---|

| High interest earnings will grow your money exponentially over time. | Limited to certain types and amounts of withdrawals and transfers. |

| You can withdraw at any time during your bank's business hours. | May require a minimum balance to avoid paying fees. |

No frill account is another name of BSBDA account that is Basic saving basic deposit account which opens on zero balance and having all facilities but in some restricted manner. It's basically a “Zero balance account” introduced as part of financial inclusion scheme.

Traditional savings accounts are offered by big, national banks and typically charge a monthly maintenance fee to keep the account open. You can often get the fee waived by maintaining a minimum balance, but if your balance dips below that requirement even for a month, you'll be charged a fee.

Basic Savings Account

A Basic Savings Account is a simple type of account that you can open with a financial institution. It simply serves the purpose of holding your money in a secure space. In exchange for this, you get to earn interest on the amount deposited.

1. Traditional Checking Account. A traditional checking account, also referred to as a standard or basic checking account, offers the ability to write checks. It also provides access to a debit card that you can use to make purchases and withdraw cash at ATMs.

What are the 4 savings accounts?

- Basic Savings Account. Also known as passbook savings accounts, these accounts are a good introduction to earning interest and saving money. ...

- Online Savings Accounts. ...

- Money Market Savings Accounts. ...

- Certificate of Deposit Account.

U.S. government securities–such as Treasury notes, bills, and bonds–have historically been considered extremely safe because the U.S. government has never defaulted on its debt. Like CDs, Treasury securities typically pay interest at higher rates than savings accounts do, although it depends on the security's duration.

Millionaires Don't Keep Much in Their Traditional Savings Accounts. “My millionaire clients keep very little of their net worth in a traditional savings account. $10,000 or less,” said Herman (Tommy) Thompson, Jr., CFP, ChSNC, ChFC, a certified financial planner with Innovative Financial Group.

As of April 2024, no banks are offering 7% interest rates on savings accounts. Two credit unions have high-interest checking accounts: Landmark Credit Union Premium Checking with 7.50% APY and OnPath Credit Union High Yield Checking with 7.00% APY.

- Low return – although consumers can earn interest, they offer relatively lower rates.

- Taxes – there are no tax benefits for putting money into a savings account. ...

- Minimum balance – most accounts have a minimum balance which, if the account falls below, causes the account holder to incur charges.

References

- https://www.consumercredit.com/about-us/news-press-releases/2017/checking-account-vs-savings-accounts-the-pros-and-cons/

- https://www.hdfcbank.com/personal/resources/learning-centre/save/what-are-the-types-of-savings-accounts

- https://www.forbes.com/advisor/banking/list-of-failed-banks/

- https://smartasset.com/checking-account/chime-vs-simple

- https://www.moneysavingexpert.com/savings/best-regular-savings-accounts/

- https://www.huntington.com/learn/saving/differences-between-checking-and-savings

- https://www.bankrate.com/banking/savings/types-of-savings-accounts/

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://www.latimes.com/compare-deals/banking/savings/7-percent-interest-savings-accounts

- https://www.bankrate.com/banking/savings/online-vs-brick-and-mortar-banks/

- https://www.britannica.com/money/saving

- https://www.forbes.com/advisor/banking/simple-bank-review-the-pros-and-cons/

- https://www.fool.com/the-ascent/banks/simple-bank-review/

- https://www.synchronybank.com/blog/what-is-a-savings-account/

- https://valueinvesting.io/PNC/probability-of-bankruptcy

- https://www.statista.com/statistics/799197/largest-banks-by-assets-usa/

- https://www.wordhippo.com/what-is/another-word-for/savings_account.html

- https://www.investopedia.com/articles/investing/093015/why-saving-10-isnt-enough-get-you-through-retirement.asp

- https://www.noradarealestate.com/blog/list-of-failed-banks/

- https://www.investopedia.com/terms/f/frozenaccount.asp

- https://www.idbibank.in/treasury-call-notice-term-money.aspx

- https://www.law.cornell.edu/wex/financial_institution

- https://www.shaalaa.com/question-bank-solutions/make-a-word-web-of-at-least-12-words-related-to-banking-writing-skills_171508

- https://www.forbes.com/advisor/banking/most-popular-banks-by-state/

- https://www.theverge.com/2021/1/7/22219271/simple-bank-online-shutting-down-pnc-bbva

- https://www.comparethemarket.com/current-accounts/basic-bank-account/

- https://www.forbes.com/advisor/banking/checking/types-of-checking-accounts/

- https://www.sofi.com/learn/content/national-banks-vs-local-banking/

- https://www.investopedia.com/best-free-savings-accounts-5191103

- https://www.investopedia.com/articles/investing/122315/worlds-top-10-banks-jpm-wfc.asp

- https://en.wikipedia.org/wiki/Simple_(bank)

- https://www.forbes.com/advisor/banking/safest-banks-in-the-us/

- https://www.businessinsider.com/personal-finance/5-percent-interest-savings-accounts

- https://www.usnews.com/banking/articles/pnc-bbva-bank-merger-what-you-need-to-know

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://www.quora.com/What-is-no-frills-bank-account

- https://www.experian.com/blogs/ask-experian/what-to-do-if-bank-closes-your-account/

- https://www.wellsfargo.com/financial-education/basic-finances/manage-money/options/bank-account-types/

- https://en.wikipedia.org/wiki/BBVA_USA

- https://www.sjsu.edu/people/tom.means/courses/FFFL/s1/912student4.pdf

- https://www.consumerfinance.gov/ask-cfpb/what-is-an-overdraft-en-1035/

- https://www.businessinsider.com/personal-finance/list-of-bank-failures

- https://moneyview.in/savings-account/best-banks-for-savings-accounts-in-india

- https://wise.com/us/blog/the-9-best-simple-bank-alternatives-in-2023

- https://www.icba.org/bank-locally

- https://www.onepercentforamerica.org/the-guide/types-banks-us

- https://www.dictionary.com/e/slang-terms-for-money/

- https://www.theverge.com/2021/5/9/22427811/simple-bbva-transition-errors-bank-shutdown

- https://www.toppr.com/guides/fundamentals-of-accounting/accounting-process/types-of-accounts/

- https://www.investopedia.com/terms/b/bank.asp

- https://www.icicibank.com/blogs/saving-account/types-of-savings-account

- https://www.marketwatch.com/guides/banking/best-online-banks/

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.oxfordlearnersdictionaries.com/definition/american_english/bank_2

- https://www.investopedia.com/articles/personal-finance/090314/4-savings-accounts-investors.asp

- https://www.thebalancemoney.com/typical-minimum-balance-for-traditional-savings-accounts-5204547

- https://time.com/personal-finance/article/what-is-a-savings-account/

- https://quizlet.com/test/econ-330-ch-11-quiz-questions-452138914

- https://www.genieai.co/define/financial-institution-name

- https://www.vocabulary.com/dictionary/bank

- https://www.dictionary.com/browse/bank

- https://fortune.com/recommends/banking/types-of-savings-accounts/

- https://www.investopedia.com/terms/c/current-account-savings-account.asp

- https://www.creditkarma.com/money/i/types-of-banks

- https://www.forbes.com/advisor/banking/savings/types-of-savings-accounts/

- https://www.lcps.org/cms/lib4/VA01000195/Centricity/Domain/2964/Banking%20Test%20-%20MoneyPower.pdf

- https://www.moneyhelper.org.uk/en/savings/types-of-savings/regular-savings-accounts

- https://www.moneyboxapp.com/faqs/what-is-the-simple-saver-and-how-does-it-work/

- https://www.jeniusbank.com/blog/articles/savings-categories-and-buckets

- https://investor.pnc.com/news-events/financial-press-releases/detail/29/pnc-achieves-national-expansion-with-conversion-of-bbva-usa

- https://www.forbes.com/advisor/banking/savings/what-is-a-savings-account/

- https://www.forbes.com/advisor/banking/why-bank-closed-my-account-what-to-do/

- https://dfi.wi.gov/Pages/ConsumerServices/WisconsinConsumerAct/DifferencesBanksCreditUnionsSavingsInstitutions.aspx

- https://www.marketwatch.com/guides/banking/largest-banks-in-the-us/

- https://www.usbank.com/bank-accounts/savings-accounts.html

- https://wallethub.com/answers/cc/who-owns-pnc-1000011-2140827724/

- https://www.icicibank.com/blogs/saving-account/advantages-disadvantages-savings-account

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://www.phroogal.com/product/simple-bank/

- https://www.businessinsider.com/personal-finance/simple-bank-closing-what-means-for-money-2021-1

- https://www.bankrate.com/banking/list-of-failed-banks/

- https://en.wikipedia.org/wiki/Financial_institution

- https://www.monito.com/en/wiki/alternatives-to-simple-bank

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking--Banks-Thrifts-and-Credit-Unions

- https://finance.yahoo.com/news/much-money-millionaires-put-checking-120013872.html

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://www.5paisa.com/blog/best-savings-bank-accounts-in-india

- https://www.vsecu.com/blog/the-power-of-seven-a-complete-guide-to-the-seven-percent-savings-rule/

- https://en.wikipedia.org/wiki/Saving

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-money-market-account-en-1007/

- https://www.nerdwallet.com/article/banking/types-of-savings-accounts

- https://quizlet.com/646059640/college-personal-finance-ch4-flash-cards/