What are the advantages and disadvantages of a regular savings account?

Pros and Cons of Saving

Saving has many benefits such as providing a financial safety net for unexpected events, liquidity for purchases and other short-term goals, and being safe from loss. However, there are also some drawbacks to consider, such as missing out on potential higher returns from riskier investments.

Pros and Cons of Saving

Saving has many benefits such as providing a financial safety net for unexpected events, liquidity for purchases and other short-term goals, and being safe from loss. However, there are also some drawbacks to consider, such as missing out on potential higher returns from riskier investments.

- Low return – although consumers can earn interest, they offer relatively lower rates.

- Taxes – there are no tax benefits for putting money into a savings account. ...

- Minimum balance – most accounts have a minimum balance which, if the account falls below, causes the account holder to incur charges.

not having enough growth potential. The return from saving accounts is normally low since the interest rate paid by the financial institutions is low. Most banks offer an interest rate of less than 5% on saving accounts. This interest rate is shallow compared to other interest-paying assets like bonds.

Savings accounts allow your money to work for you by earning interest over time and facilitating automatic bill payments, contributing to effective financial management.

In addition to earning interest, money in a deposit savings account is readily available. One of the biggest advantages of a savings account is that your money is fully accessible to you. You have access to your money through an ATM, online banking, our mobile app, or a transaction with a teller at one of our branches.

Saving at a bank helps you manage your finances in a more organized and planned manner. Having a savings account lets you separate funds used for daily needs from savings funds. You can also check your savings funds' incoming and outgoing flows through neatly recorded transaction history or account mutations.

- Demonetization - ...

- Exchange Rate Instability - ...

- Monetary Mismanagement - ...

- Excess Issuance - ...

- Restricted Acceptability (Limited Acceptance) - ...

- Inconvenience of Small Denominators - ...

- Troubling Balance of Payments - ...

- Short Life -

Lack of Growth or Returns: Another issue with saving money in banks is the relatively low interest rates that traditional savings accounts offer. With inflation rates often outpacing interest rates, the real value of your savings might decrease over time.

- Low-Interest Rates. Savings Accounts offer an interest rate that ranges between 2.50% to 7% per annum. ...

- Fees. ...

- Minimum Balance Requirements. ...

- Accessibility Restrictions. ...

- Opportunity Cost.

What are the disadvantages of bank account?

- Interest rates can change. Savings account interest rates in India can fluctuate, leading to variable returns. ...

- Minimum balance requirements. ...

- Withdrawal limits. ...

- Inflation. ...

- Compounded interest.

- The money can be lost or stolen. Hiding cash under the mattress, behind a picture frame or anywhere in your house always carries the risk of being misplaced, damaged or stolen. ...

- The money isn't growing. When cash doesn't grow, it loses some of its value.

Basic bank accounts don't provide an overdraft, meaning you won't be a credit risk to your provider. You have no credit history – sometimes having no credit history can be just as damaging, as providers have no record of your ability to reliably borrow or spend responsibly.

A drawback of a regular savings account is: A relatively low rate of return.

Being unbanked means things like cashing checks and paying bills are costly and time-consuming. Those who are unbanked often must rely on check cashing services to cash paychecks because they don't have direct deposit. They also have to pay bills using money orders, which adds time and expense to the process.

With a savings account, you'll have easy access to your money and earn a little interest on the balance. A CD typically pays more interest, but access to your money is limited.

With a regular Savings Account, you will have to maintain a minimum account balance. This account is perfect for your day-to-day banking needs. This is similar to the regular Savings Account, but unlike that account, you are not required to maintain any minimum balance for this account.

One solid option is to use a savings account — but not all savings accounts are created equal. If you're using a traditional savings account rather than one of the high-yield variety, you could be missing out on significant interest earnings.

One advantage of a regular savings account is that it has high liquidity, meaning that you can get your money out easier. One disadvantage of a regular savings account is that it has low interest rates.

Bank of America Advantage Savings does not earn a competitive APY, even for Preferred Rewards members, and it carries a monthly fee except for minor and college students under 25 years of age.

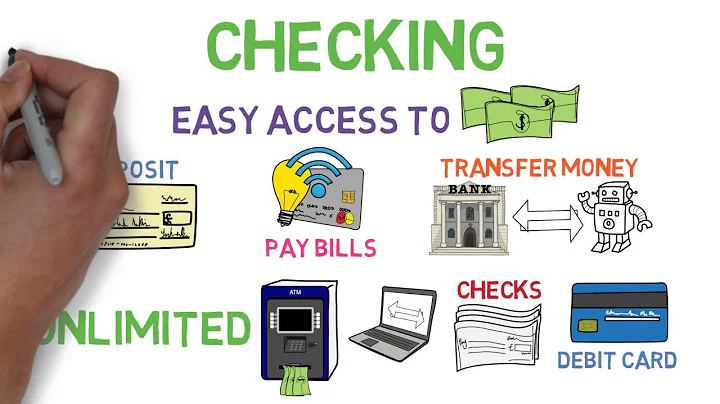

What are the advantages and disadvantages of a checking account?

Disadvantages are getting little to no interest on the balance of the account, account fees, no physical cash, having to remember a PIN, and not building credit. Most people and businesses would benefit from opening a checking account to manage their finances.

Basic bank accounts don't provide an overdraft, meaning you won't be a credit risk to your provider. You have no credit history – sometimes having no credit history can be just as damaging, as providers have no record of your ability to reliably borrow or spend responsibly.

References

- https://www.moneysavingexpert.com/savings/best-regular-savings-accounts/

- https://www.comparethemarket.com/current-accounts/basic-bank-account/

- https://www.meettally.com/blog/traditional-savings-account

- https://www.fool.com/the-ascent/banks/articles/heres-what-happens-when-you-leave-a-lot-of-money-in-your-savings-account/

- https://www.bankrate.com/banking/savings/what-is-a-savings-account/

- https://www.cnet.com/personal-finance/banking/advice/yes-you-can-spend-from-your-savings-account-but-should-you/

- https://www.gobankingrates.com/saving-money/budgeting/how-to-survive-on-500-dollars-a-month/

- https://diversifiedllc.com/article/what-are-the-pros-and-cons-of-traditional-banking/

- https://www.fool.com/the-ascent/banks/articles/3-ways-you-can-lose-money-in-a-savings-account/

- https://www.creditkarma.com/ck-money/checking

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://www.unionbankofindia.co.in/english/ultimate-guide-to-savings-accounts.aspx

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www.icicibank.com/blogs/saving-account/advantages-disadvantages-savings-account

- https://www.kotak.com/en/stories-in-focus/accounts-deposits/savings-account/savings-account-advantages-and-disadvantages.html

- https://www.chase.com/personal/banking/education/budgeting-saving/the-best-reasons-to-open-a-savings-account

- https://www.forbes.com/advisor/in/banking/types-of-savings-accounts/

- https://www.investopedia.com/how-much-cash-can-you-deposit-at-a-bank-8553483

- https://www.nerdwallet.com/article/banking/accounts-at-multiple-banks

- https://www.takechargeamerica.org/the-many-downsides-of-being-unbanked/

- https://time.com/personal-finance/article/how-much-cash-to-keep-in-checking-account/

- https://www.cbsnews.com/news/high-yield-savings-vs-regular-savings-account-how-much-more-could-you-be-earning/

- https://study.com/academy/lesson/what-is-a-checking-account-definition-types-advantages.html

- https://www.bankrate.com/banking/checking-vs-savings-accounts/

- https://www.fool.com/the-ascent/banks/savings-accounts/bank-of-america-advantage-savings-review/

- https://quizlet.com/646059640/college-personal-finance-ch4-flash-cards/

- https://www.halifax.co.uk/savings/help-guidance/saving-explained/what-is-a-lump-sum.html

- https://www.dbs.com/digibank/in/articles/save/how-to-calculate-monthly-average-balance

- https://www.forbes.com/advisor/banking/savings/types-of-savings-accounts/

- https://playmoneysmart.fdic.gov/tools/4

- https://www.marketwatch.com/guides/banking/chase-review/

- https://finance.yahoo.com/news/much-money-millionaires-put-checking-120013872.html

- https://www.consumercredit.com/about-us/news-press-releases/2017/checking-account-vs-savings-accounts-the-pros-and-cons/

- https://homework.study.com/explanation/what-is-the-major-disadvantage-of-having-a-regular-savings-account-a-not-having-enough-growth-potential-b-having-a-minimum-amount-of-money-deposited-to-keep-it-open-c-having-an-expiration-date-d-not-being-able-to-access-money-for-a-specified-amount-o.html

- https://www.nerdwallet.com/uk/savings/regular-savings-account/

- https://www.comerica.com/insights/personal-finance/advantages-of-a-savings-account-security-access-and-more.html

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.cnn.com/cnn-underscored/money/can-you-add-money-to-a-cd

- https://finance.yahoo.com/news/live-1-000-per-month-200011859.html

- https://fdlcu.com/should-you-keep-cash-at-home.html

- https://quizlet.com/442558382/savings-accounts-flash-cards/

- https://www.cbsnews.com/news/how-much-is-too-much-money-for-a-high-yield-savings-account/

- https://www.businessinsider.com/personal-finance/5-percent-interest-savings-accounts

- https://www.fool.com/the-ascent/personal-finance/articles/should-you-empty-your-savings-accounts-to-become-debt-free/

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://finance.yahoo.com/news/20-000-good-amount-savings-160036732.html

- https://dspmuranchi.ac.in/pdf/Blog/8)%20DEMERITS%20OF%20MONEY.pdf

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://brainly.com/question/41557870

- https://smartasset.com/career/what-should-my-net-worth-be-at-35

- https://www.forbes.com/advisor/banking/bank-account-minimum-deposit-minimum-balance-requirements/

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.gripinvest.in/blog/earn-50K-per-month

- https://quizlet.com/80817357/personal-finance-unit-4-flash-cards/

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/money-market-vs-cd-vs-savings

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.cnbc.com/2017/09/14/how-much-money-the-average-millennial-has-in-savings.html

- https://www.toppr.com/guides/fundamentals-of-accounting/accounting-process/types-of-accounts/

- https://fortune.com/recommends/banking/traditional-savings-account/

- https://www.icicibank.com/blogs/saving-account/what-is-monthly-average-balance

- https://www.forbes.com/advisor/banking/how-much-cash-should-you-keep-in-the-bank/

- https://www.forbes.com/advisor/banking/online-banks-vs-traditional-banks/

- https://www.usnews.com/banking/articles/what-is-a-savings-account

- https://gocardless.com/guides/posts/what-is-a-passbook-and-how-is-it-used/

- https://www.nerdwallet.com/article/banking/how-much-should-i-have-in-savings

- https://www.cnbc.com/select/how-much-money-you-should-save-every-paycheck/

- https://www.rocketmoney.com/learn/personal-finance/living-paycheck-to-paycheck

- https://www.nerdwallet.com/article/banking/types-of-savings-accounts

- https://www.finder.com/savings-accounts/savings-account-you-cant-withdraw-from

- https://www.forbes.com/advisor/banking/savings/how-much-should-i-have-saved-by-30/

- https://www.moneyhelper.org.uk/en/savings/types-of-savings/regular-savings-accounts

- https://www.axisbank.com/progress-with-us-articles/advantages-and-disadvantages-of-savings-account

- https://www.linkedin.com/pulse/3-primary-types-bookkeeping-anthony-thompson-dmnpc

- https://www.synchronybank.com/blog/what-is-a-savings-account/

- https://quizlet.com/370269258/consumers-chapter-3-savings-flash-cards/

- https://www.bankrate.com/banking/savings/average-savings-interest-rates/

- https://consumer.westchestergov.com/money-management/benefits-of-a-bank-account

- https://www.sofi.com/learn/content/surviving-on-1000-a-month/

- https://www.raisin.co.uk/savings-accounts/locked-savings-accounts

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://www.bankrate.com/banking/savings/types-of-savings-accounts/

- https://www.ally.com/help/bank/savings-money-market/

- https://www.forbes.com/advisor/banking/savings/are-high-yield-savings-accounts-worth-it/

- https://www.bankrate.com/uk/savings-accounts/choosing-a-savings-account/

- https://www.quora.com/What-do-you-consider-a-small-amount-of-money

- https://www.nasdaq.com/articles/5-key-signs-youre-keeping-too-much-money-in-your-savings-account

- https://www.huntington.com/learn/checking-basics/online-banking-vs-traditional-banking

- https://www.forbes.com/advisor/banking/checking/types-of-checking-accounts/

- https://www.investopedia.com/how-many-savings-accounts-should-i-have-7775519

- https://www.sofi.com/learn/content/avoiding-minimum-balance-fee/

- https://www.latimes.com/compare-deals/banking/savings/7-percent-interest-savings-accounts

- https://www.investopedia.com/terms/m/minimum-balance.asp

- https://www.cnn.com/cnn-underscored/money/average-american-savings

- https://www.forbes.com/advisor/banking/cds/7-percent-cd-rate/

- https://www.experian.com/blogs/ask-experian/is-5000-emergency-fund-enough/

- https://www.huntington.com/learn/saving/savings-account-advantages

- https://www.hdfcbank.com/personal/resources/learning-centre/save/what-are-the-types-of-savings-accounts

- https://www.takingcharge.csh.umn.edu/can-money-buy-happiness

- https://www.forbes.com/advisor/banking/checking/average-checking-account-balance/

- https://www.cnbc.com/select/tips-for-getting-your-first-100k/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.moderntreasury.com/learn/what-is-an-fbo-account

- https://www.cnbc.com/select/how-much-money-should-you-keep-in-bank-accounts/

- https://www.linkedin.com/pulse/challenges-saving-money-banks-in-depth-analysis-finveomn

- https://www.marketwatch.com/picks/5-things-you-should-never-do-with-your-savings-18366c78

- https://www.suntecgroup.com/articles/how-minimum-balance-requirements-can-benefit-banks-and-customers/

- https://en.wikipedia.org/wiki/Minimum_daily_balance

- https://www.thebalancemoney.com/typical-minimum-balance-for-traditional-savings-accounts-5204547

- https://www.quora.com/How-much-cash-can-be-deposited-into-a-savings-bank-account-per-year-without-being-taxed-by-the-Internal-Revenue-Service-IRS

- https://www.cnbc.com/select/can-you-have-too-much-in-savings/

- https://www.wellsfargo.com/financial-education/basic-finances/manage-money/cashflow-savings/pay-yourself-first/

- https://finance.yahoo.com/news/retire-2-000-month-frugal-130016009.html

- https://www.coursesidekick.com/economics/386990

- https://brainly.com/question/29214667

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://www.equifax.com/personal/education/life-stages/articles/-/learn/how-much-should-i-have-saved-by-middle-age/

- https://time.com/personal-finance/article/what-is-a-savings-account/

- https://homework.study.com/explanation/a-drawback-of-a-regular-savings-account-is-a-a-low-rate-of-return-b-a-minimum-required-deposit-c-not-being-insured-d-a-possible-penalty-for-early-withdrawal-e-all-of-these-are-drawback-of-a-regular-savings-account.html

- https://www.banks.com/articles/banking/savings-accounts/savings-accounts-advantages-disadvantages/